Sepehr Energy Jahan is using front companies to sell oil to middlemen, who then sell it to Chinese "Teapots" - independent, privately owned oil refineries, operating with a quiet blessing from the Chinese government.

Sepehr Energy Jahan (SEJ) is the trading arm of Iran's Armed Forces General Staff (AFGS), which is involved in the sale of petroleum, condensates, and petroleum products. The company operates in a similar manner to Sahara Thunder, that acted as a trading arm for Iran's Ministry of Defense and Logistics (MODAFL), which was also exposed in our previous reportings.

SEJ's oil sales process is complex and, until recently, confidential. The company uses front companies to sell oil to middlemen, who then sell it to refineries, also referred to by SEJ as "End Users", "End Buyers" or "Exit Buyers". As part of its business conduct, SEJ demands to know the End Buyer’s identity before approving the deal, aiming to avoid profit-deteriorating competition over the same refineries. These refineries later “blend” their Iranian oil into the Chinese market.

All identified End-Users are Chinese refineries, known as “Teapots” - small, independent, privately owned oil refineries that are well-known participators in the sanctioned petroleum trade, operating with a quiet blessing from the Chinese government. Notably, one of the “Teapots” found in the database, “Shandong Shouguang Luqing Petrochemical” was designated by the US Treasury in March 2025, as part of the renewed Maximum Pressure Campaign.

Case Study: Hengli Petrochemical Refinery’s Purchase of Heavy Crude Oil

-

Since the reimposition of US sanctions on Iranian oil, a large quantity of such oil has been stored at Dalian, China. SEJ’s documents show that the storage company is “NSK Dalian International Trading Co. Ltd”.

-

Iran’s National Oil Company (NIOC) appointed “Milen Trading”- SEJ’s front company - as their representative to negotiate and release the sanctioned stored oil in Dalian.

“This letter is to formally notify that the ownership of the whole crude oil currently stored in the Dalian and Changxing’s tanks (about 20 million barrels) will be transferred to ‘’ Milen Trading Co. Limited ’’ (with license No.76393312-000-04-24-2) who is acting as our representative for the reloading of Iranian Crude Oil from the Dalian and Changxing’s tanks.”

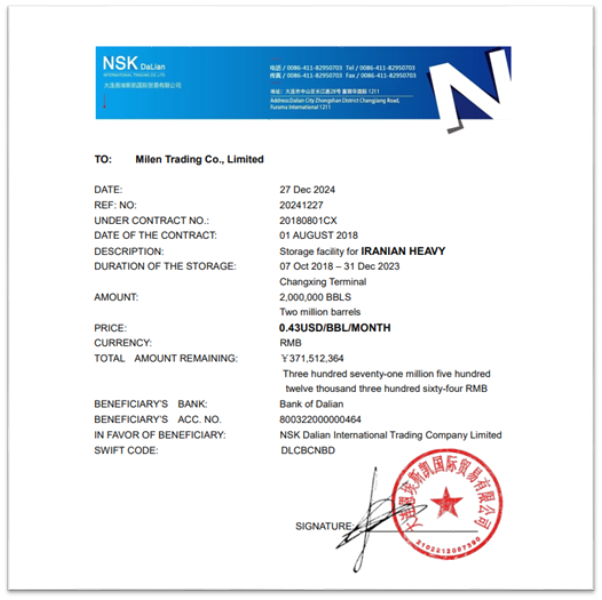

- By the end of December 2024, “Milen Trading” and “NSK” reached a deal, under which Milen would pay for most of the storage time (October 7th, 2018 – December 31st, 2023) of some 2.58 million barrels of sanctioned oil in return for their release. The oil was transferred in two shipments.

- The First shipment consisted of 2 million barrels of “Iranian Heavy” crude oil.

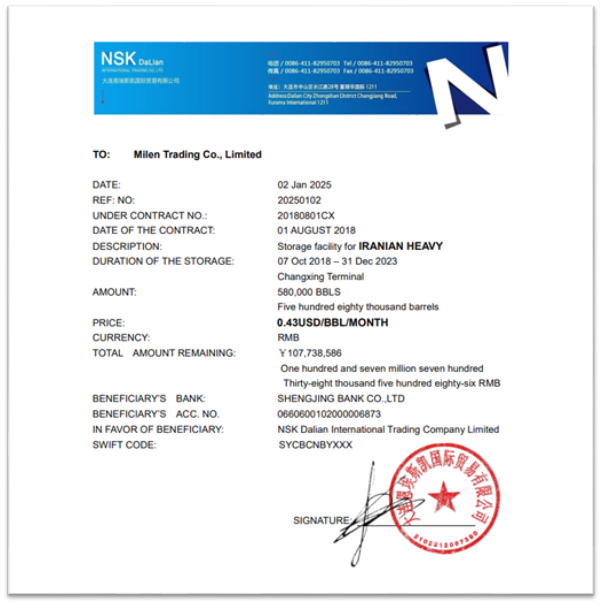

- The second shipment consisted of 580,000 barrels.

- An Email Correspondence between NSK and Millen Trading sheds light on the progress of releasing and selling these shipments.

According to the storage invoices, the first and second shipments were to consist 2 million and 580,000 barrels, respectively, totaling 2.58 million barrels. The actual loading quantities were slightly different: 1.88 million barrels for the first loading and 700,000 barrels for the second loading, yet the total amount of barrels remained the same - 2.58 million barrels. As explained in the email correspondence: “…The first provisional invoice was for 2 million barrels but the acutal loaded quantity was about 1.88 million barrels. The different is about 120.000 barrels. The provisional invoice for the Aframax should be for 700.000 barrels but we only charged for 580.000 barrels."

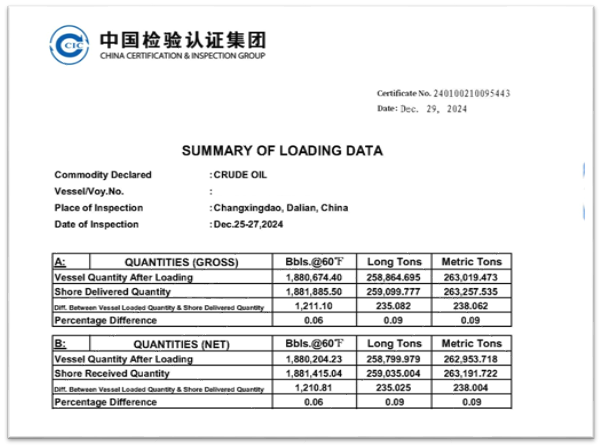

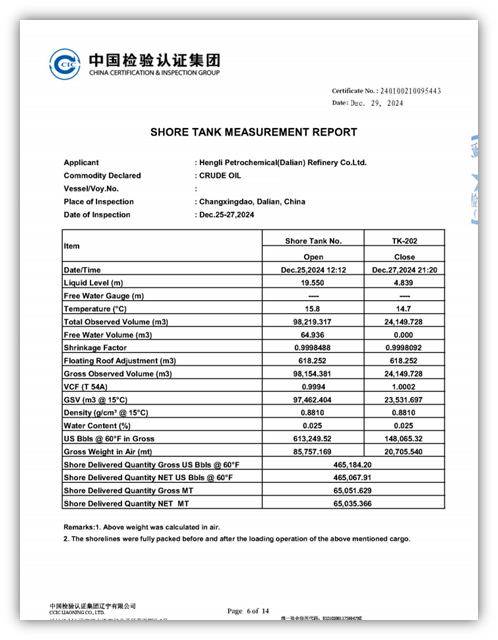

- The same email correspondence had a file attached, named “2024.12.25KINGLOADING.pdf” (Certificate No. 240100210095443), consisting of various documents relating to the first shipment. For example, the summary of loading data had a quantity matching first shipment’s values.

- Although the vessel’s name was purposely omitted from the certificates of “2024.12.25KINGLOADING.pdf”, the file’s unusual name enables us to identify the vessel’s name: “KING PLUS", which appears in another mail correspondence :

“We appointment your good company as MT KING PLUS local agent for the vessel loading at”.

This matches a Lloyd’s list article exposing “KING PLUS” as a sanctioned VLCC engaged in Iranian oil shipping. . 9. Despite omitting King Plus’s name, the same certificate (No. 240100210095443) did not omit the oil’s end-user, mentioned as the applicant for this certificate- “Hengli Petrochemical(Dalian) Refinery Co.Ltd”.

The Refineries Appearing as Possible Receivers of SEJ’s Petroleum:

| Refinery’s Name | Location |

|---|---|

| Hengli Petrochemical (Dalian) Refinery | Dalian |

| Hualian Petrochemical Refinery | Dongying |

| Shandong Qincheng Petrochemical Refinery | Shandong |

| Qingdao Chengfeng Petrochemical Co | Chengfeng |

| Hebei Jinnuo PC Co LTD Refinery. | Hebei |

| Xianglu Petrochemicals Co. Ltd | Zhangpu |

| Weifang Hongrun Petrochemical Company | Weifang |

| Shandong Shouguang Luqing Petrochemical Co., LTD | Shandong |

| QingDao Fushen Petrochemical Co., Ltd | Qingdao |

| Shandong Kenli Petrochemical Group Co. Ltd. | Shandong |

| Hebei Refinery | Hebei |

| Shandong Refinery, Yantai Hengyang Company | Shandong |